How to Mantain VAT in Invoice Lines Manually?

By default existing VAT rules are applied automatically while adding product with VAT in Invoice line.

To edit VAT settings per Invoice line manually:

- Select the needed Invoice line.

- In case you want to select the ‘VAT Product’ with exact rules for that destination, check that Invoice line has got a right destination and origin (values in ‘Destination’ and ‘Origin’ columns).

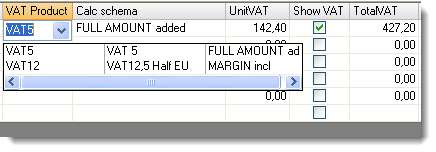

- Select VAT Rule (VAT Product and Calculation Schema) from ‘VAT Product’ combo box.

![]() NOTES:

NOTES:

• It is allowed to select only those VAT Rules for a product which are specified in product's profile.

• Right after selecting VAT Rule, VAT becomes recalculated based on made selections.

• Destination and Origin affect only VAT rules applying. If VAT product and Calc schema is set, it is calculated correctly no matter of destination and origin.

• It is not allowed to set calculation schema until there is no ‘VAT Product’ selected, because it depends on the selected VAT.