Table of Contents

How VAT from PNR is treated

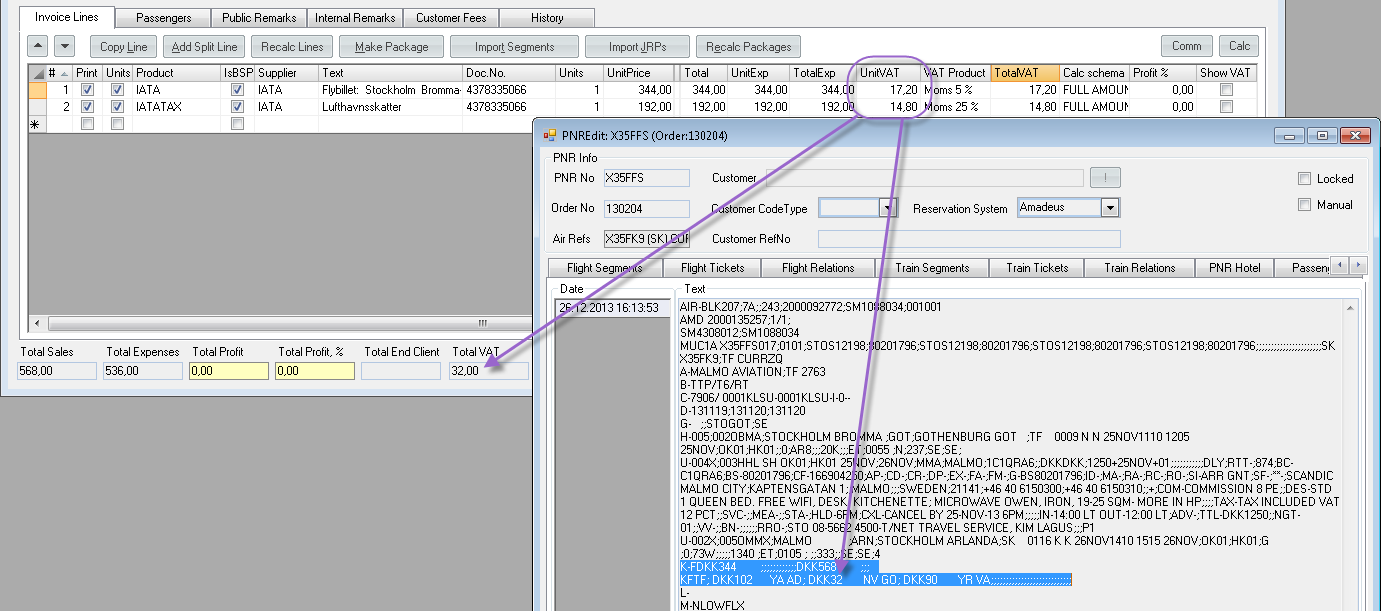

In case there is a VAT on flight, PNR contains exact amount, and it is transferred in Application with a special code (set in Company Settings → Settings → Invoicing → VATIATATaxCode), for example, XS in Sweden.

This amount is % of fare+taxes, rounded by GDS (Amadeus).

Prehistory

In old Travelwise (VB6) this amount was splitted precisely into IATA and IATATAX lines.

In Travelwise.net Application we just took % from VAT rule, applied it to lines, calculated VAT amount and validated if the amount was more or less close to the Amadeus VAT. BUT, due to rounding, VAT in Application was slightly different compared to GDS.

Now

Sum of VAT amounts from IATA and IATATAX lines gives exactly the same VAT like in a PNR (VAT is calculated for IATA and then difference goes to IATATAX line).

Important

Please be aware of manual changes in invoice after it has been once generated, that can cause recalculation of lines and erasing of originally correct amount.