How VAT is Displayed in a Printed Invoice?

VAT presentation depends on ‘InvoiceShowVATperInvoiceLine’ HC option and ‘Show VAT’ option on invoice line.

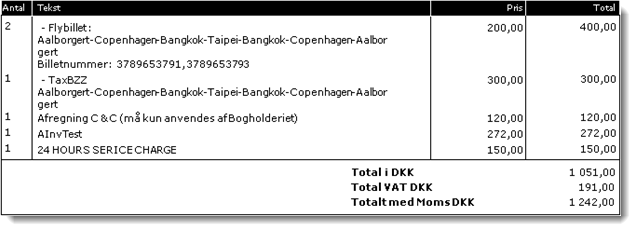

If ‘InvoiceShowVATperInvoiceLine’ HC option is unchecked, then VAT line is not shown under each product which has VAT.

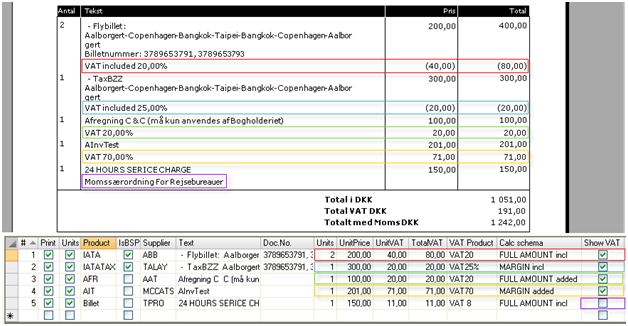

If ‘InvoiceShowVATperInvoiceLine’ HC option is checked, then VAT line is shown under each the product which has VAT. But Total VAT amount is displayed.

When ‘Show VAT’ is not set in Invoice line, then VAT amount is included into Total, and Total VAT is not shown in Invoice report.

VAT amount from a line inside a Package is also not shown in Total VAT. VAT line is always hidden in a report for Product in Package.

If product has no VAT, the VAT line is not displayed in a report.

For 'Package' Invoice line the same rules are applied as for product.

VAT in a printed Invoice is shown depending on VAT calculation schema (see example above for ‘BK CPH’ Invoice template):

| Displaying in Invoice report (printed Invoice) | VAT calculation schema | |

|---|---|---|

| Added | Included | |

| Shown in Invoice line | Ticket Faraway to ABC 5.000 (price w/o VAT) | Ticket Faraway to ABC 5.100 (price with VAT) |

| VAT 100 | VAT included (100) | |

| Shown in Total | Invoice Total: 5.000 (price w/o VAT) | Invoice Total: 5.000 (price w/o VAT) |

| VAT total 100 | Total VAT 100 | |

| Hidden in Invoice line | Ticket Faraway to ABC 5.100 (price with VAT) | Ticket Faraway to ABC 5.100 (price with VAT) |

| Special text … | Special text … | |

| Hidden in Total | Invoice Total 5.100 (price with VAT) | Invoice Total 5.100 (price with VAT) |

| no Total VAT shown | no Total VAT shown | |

Note

- 'InvoiceShowVATperInvoiceLine' HC setting and 'Show VAT' option do not affect displaying the Total VAT for BkOsl, NtsOsl, NtsHel, NtsPar, VIE invoice templates as they have special VAT section.

- Invoice lines with VAT=0 are hidden for Billetkontoret' template.